Author| BloFin Academy

Compiled| WuBlockchain

TL;DR:Whale 2026 Market Outlook — — Liquidity and the New Order

· Liquidity Tightening: The Fed's "defensive rate cuts" in 2025 did not bring the liquidity flood the market expected. Instead, massive margin credit and repo market-based financing continued to drain cash/reserves from the banking system; meanwhile, massive issuance of T-bills by the U.S. Treasury made liquidity more reliant on a short-duration, frequently rolled financing structure, leading to a damaged and deteriorating quality of dollar liquidity.

· Shift in Allocation Logic: "Strict Diversification" returns. Capital no longer solely anchors to dollar assets but flows to gold, non-dollar currencies, and supply-constrained assets.

· Three Core Themes: In the context of regionalization, resources (supply side), AI infrastructure (computing power/energy), and defense/security become the asset classes with the highest certainty.

· Crypto Asset Divergence: 2026 is a watershed. Bitcoin, as a "digital commodity", will assume a hedging function, while equity-like tokens need to provide higher risk compensation under the pressure of clear regulation and high risk-free rates.

· Core Conclusion: The global market pricing logic is undergoing a paradigm shift — from "buying growth (efficiency)" in the globalization era to彻底switching to "buying location (security)" in the regionalization era. In the current complex liquidity risk environment, embracing supply-constrained hard assets (resources/computing power/defense) is the only solution to应对the "new order".

Liquidity: Not Abundant, Quality is Deteriorating

At the beginning of 2025, the main "bullish" factor in investors' minds was Trump's formal inauguration. The mainstream view was that he would trigger more rate cuts, inject liquidity, and push up asset prices.

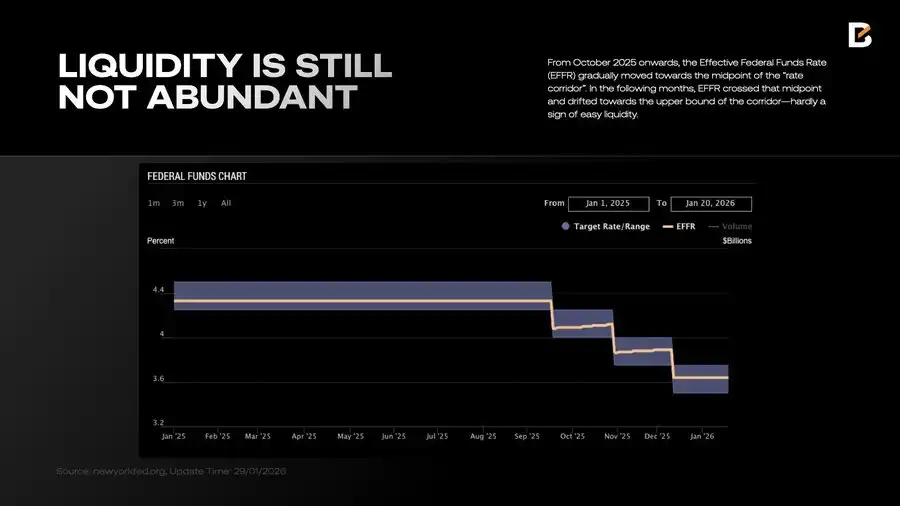

In fact, from September to December 2025, out of concern for the labor market, the Fed did implement three "defensive" rate cuts and announced the end of quantitative tightening (QT). But this did not bring the "liquidity flood" investors期盼for. From October, the effective federal funds rate (EFFR) gradually moved towards the midpoint of the "interest rate corridor", and later even drifted past the midpoint to the corridor上限— this is by no means a sign of loose liquidity.

EFFR is the core short-term market rate in the US, reflecting the funding liquidity conditions of the banking system. In periods of loose liquidity, EFFR usually stays close to the corridor下限(because banks don't need to borrow frequently). However, in the last few months of 2025, banks were clearly facing liquidity stress — a key driver pushing up EFFR.

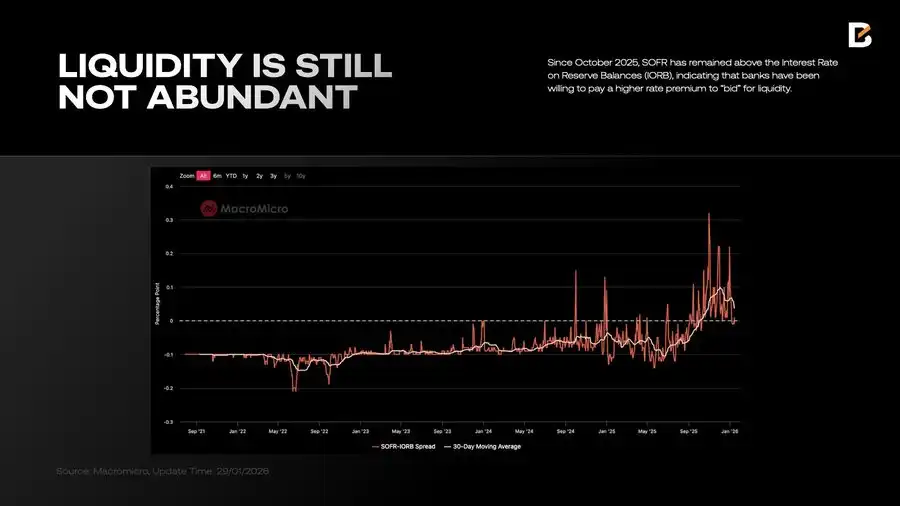

The SOFR-IORB spread further highlights this pressure. If EFFR reflects the cash market, then SOFR (secured financing rate with Treasury collateral) captures broader liquidity shortages. Since October 2025, SOFR has consistently been higher than the interest on reserve balances (IORB), indicating that banks are willing to pay a premium to "bid" for liquidity even with collateral.

Even after the Fed stopped shrinking its balance sheet, the SOFR-IORB spread did not fall significantly in January. A reasonable explanation is: the liquidity in banks' hands is being used heavily for financial investment, not lending to the real economy.

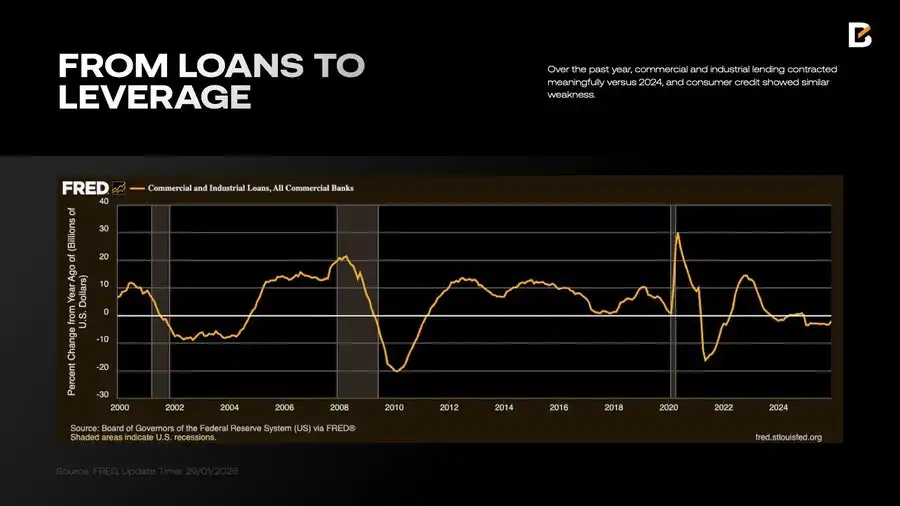

Credit Contraction: Over the past year, commercial and industrial loans have shrunk significantly compared to 2024, and consumer credit has also been weak.

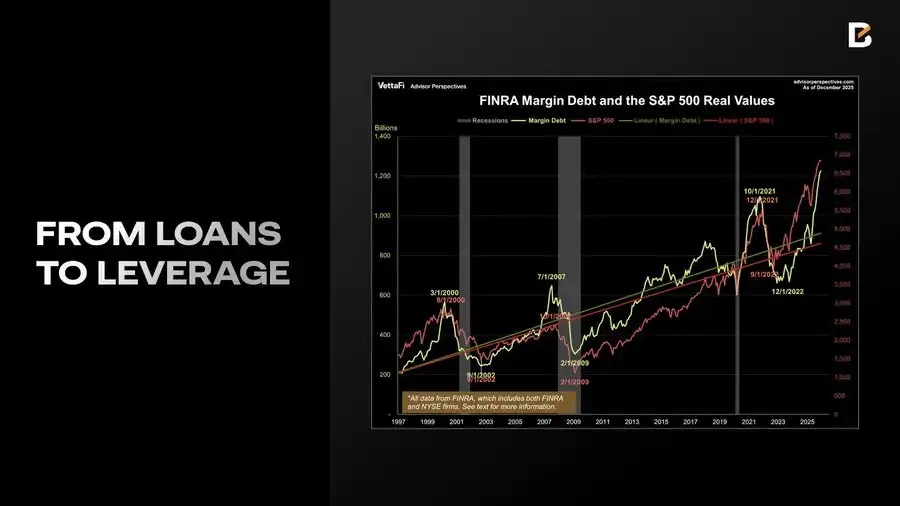

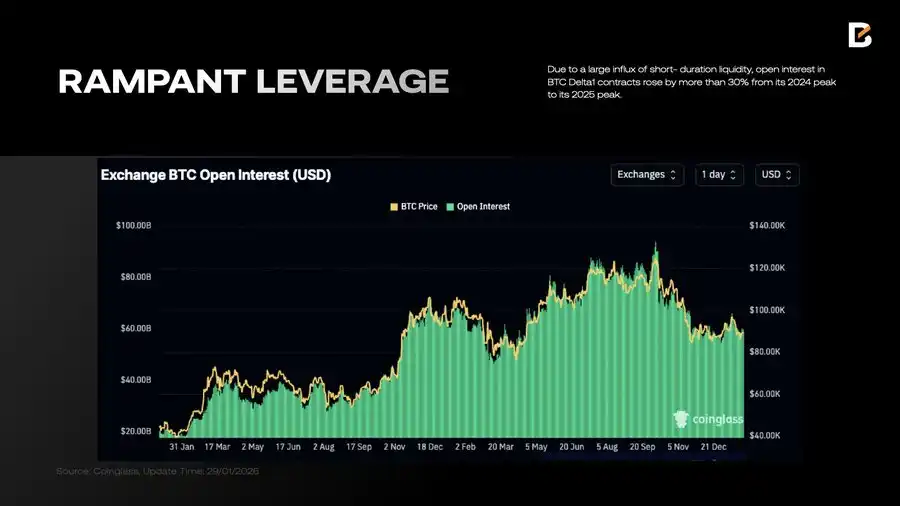

Leverage Surge: In contrast, margin credit (Margin Debt) grew逆势by 36.3%, hitting a historical high of $1.23 trillion in December; investors' net debit balances also expanded to -$814.1 billion, moving in step with the growth of margin credit.

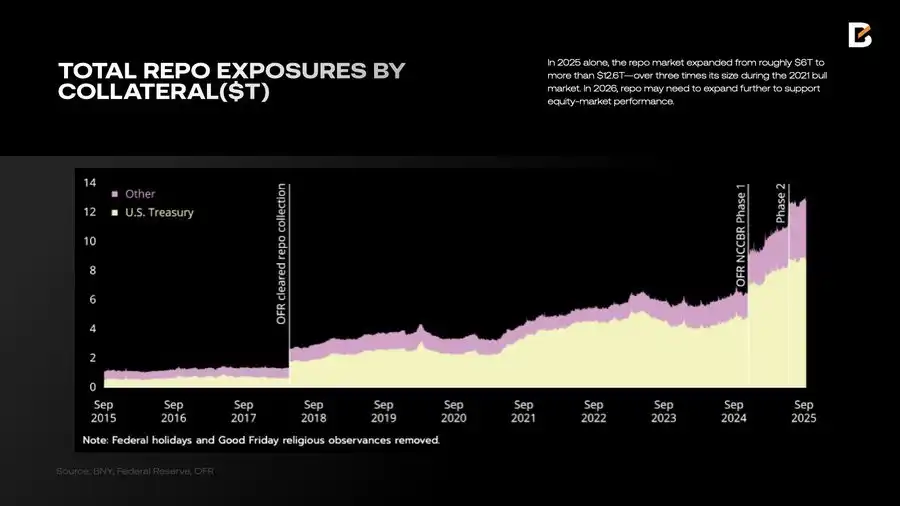

As the liquidity requirements to push the market higher increase, the banking system shows stress. To maintain high valuations without triggering a stock market sell-off (a path unacceptable to the White House), the market relies heavily on the repo market for输血. In 2025 alone, the size of the repo market surged from about $6 trillion to over $12.6 trillion — more than three times its size during the 2021 bull market. In 2026, the repo market may need to expand further to support the stock market.

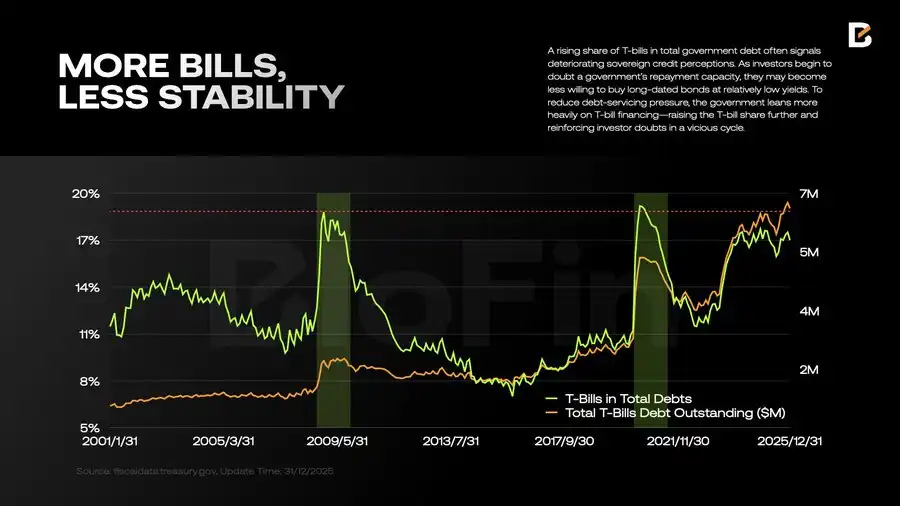

Repo transactions typically use US Treasury notes (T-notes) as collateral. But since mid-2023, the issuance volume and proportion of Treasury bills (T-bills) have grown "exponentially". This is not a benign signal: a rising T-bill proportion usually indicates deteriorating sovereign credit quality. When investors doubt the government's ability to repay debt, the government is forced to rely on short-term financing, causing the T-bill proportion to rise further,陷入a vicious cycle.

Another direct consequence of the rising T-bill proportion is: changes in liquidity size are no longer stable. Over-reliance on short-term T-bills means more frequent rollovers and a shorter average "lifespan" of liquidity. With overall leverage already at historical peaks, frequent and severe liquidity fluctuations削弱the market's ability to withstand shocks — laying the groundwork for potential cascading liquidations.

In short: The quality of dollar liquidity deteriorated significantly in 2025, with no signs of improvement yet.

Risk Premium and "Strict Diversification"

The direct cost of declining dollar liquidity quality is persistently high long-term funding costs. As US debt surged (reaching $38.5 trillion by end-2025) and policy uncertainty increased, systemic risk premiums rose accordingly. Although policy rates were cut by 75 basis points, the 10-year Treasury yield, a long-term anchor, fell by only 31 basis points, meaning long-term funding costs stubbornly remained above 4%.

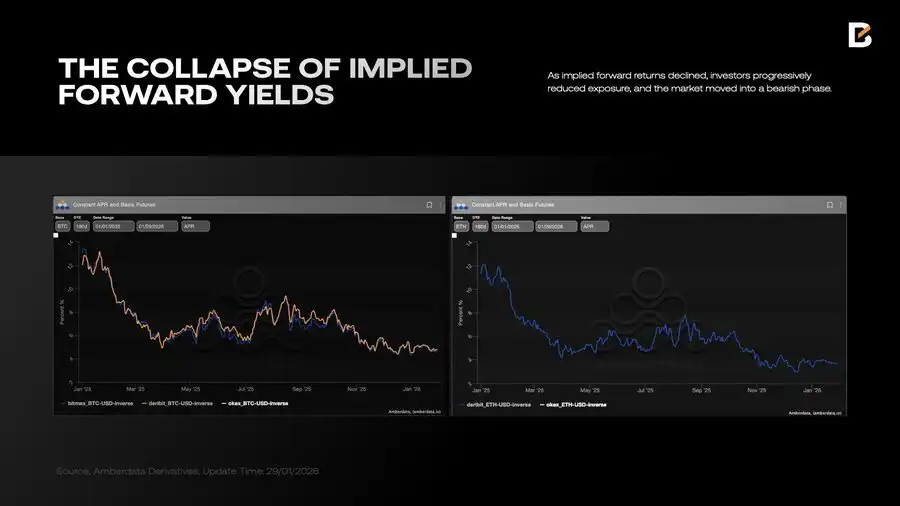

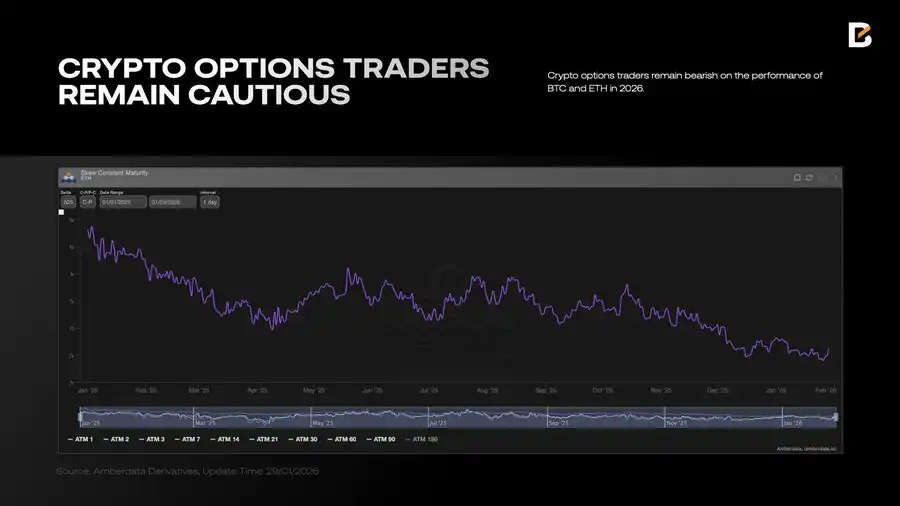

High funding costs directly limit position allocation. When the implied forward return of a risky asset falls below the Treasury yield, holding that asset long-term loses its appeal. Cryptocurrency is a textbook example: as implied returns declined, investors gradually reduced exposure, inevitably leading the market into a bearish phase.

Compared to expensive long-term liquidity, short-term financing obtained through T-bills is much cheaper. But this creates a natural environment favorable to speculation: investors tend to "borrow short-term debt, use high leverage, and trade quickly". Although the market may seem lively in the short term, such speculative bubbles make rallies difficult to sustain — this is vividly reflected in the crypto market, which is extremely sensitive to liquidity.

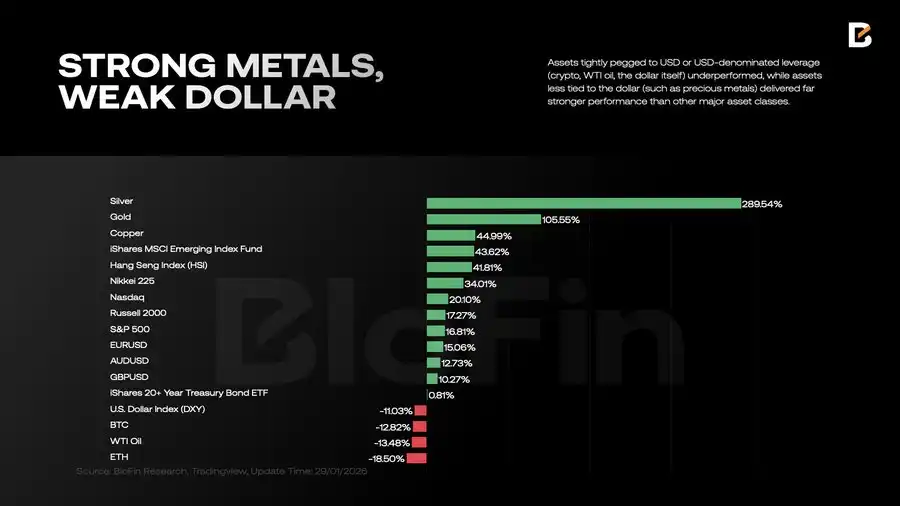

Meanwhile, 2025 witnessed the return of the "strict diversification" strategy. Unlike the traditional 60/40 strategy, liquidity is no longer confined to dollar assets but is分散to a wider range of targets. In fact, investors steadily reduced their share of dollar and dollar-pegged assets throughout the year. The results are clear: assets tightly bound to dollar leverage (like cryptocurrencies, WTI crude oil, the dollar itself) performed weakly, while assets with low correlation to the dollar (like precious metals) significantly outperformed other major asset classes.

Notably, simply holding euros or Swiss francs performed no worse than holding the S&P 500 index. This indicates a profound shift in investor logic — a shift that transcends a single business cycle.

The New Order

What is most reassessment in 2026 is not a linear question like "is growth strong", but that the market is adopting a new set of pricing grammar. The two major assumptions that supported returns in the past two decades — "extremely efficient supply chains" and "the central bank's infinite backstop" — are crumbling. They are being replaced by "regionalization", where the objective function of the global economy shifts from "efficiency at all costs" to "efficiency under security constraints".

Under this framework, the key to allocation is no longer betting on a single direction, but recalibrating exposure to three "hard variables": supply constraints, capital expenditure (Capex), and policy-driven order flow.

Equity Strategy: From "Buying Growth" to "Buying Location"

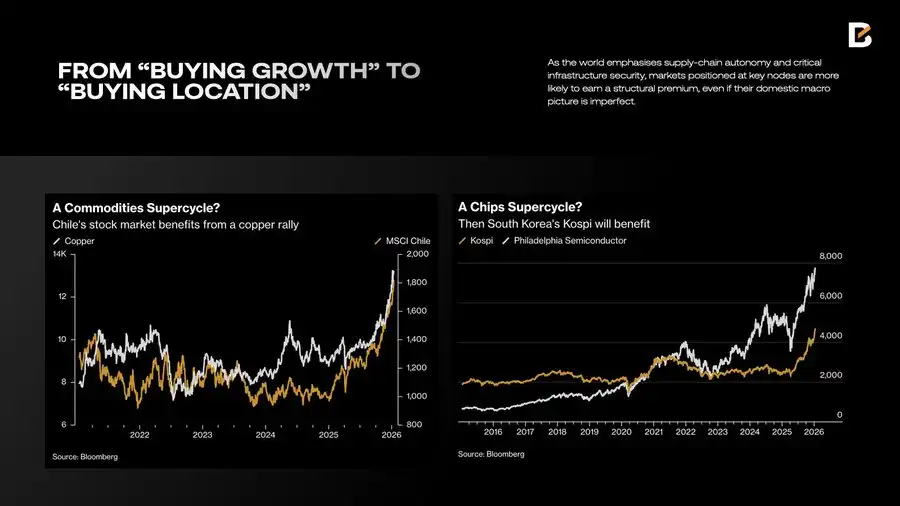

If the past decade was about "buying growth", then 2026 is about "buying location" — that is, the asset's position on the map of resources, computing power, and security.

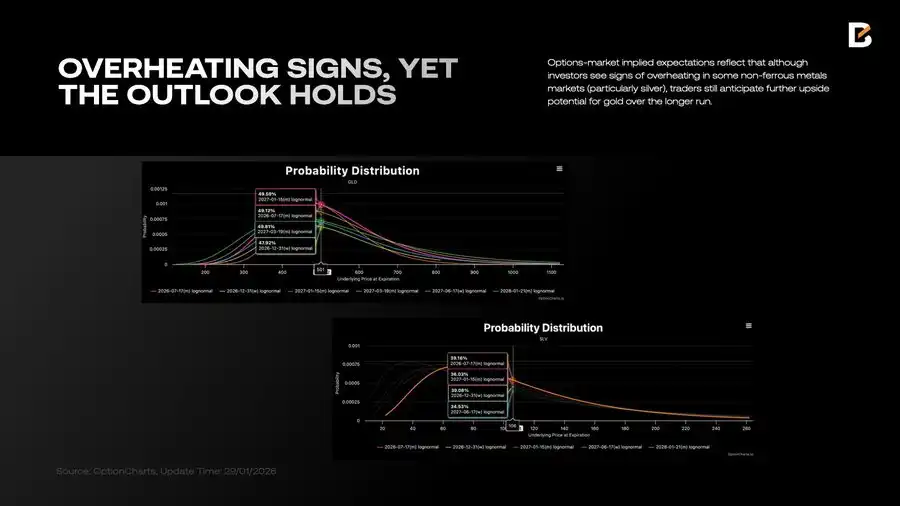

First are resources (supply-side assets). In a security-first era, increasing inventories of commodities (gold, silver, copper) is rational even when not urgently needed. This gives commodities not just the属性of being a mirror of the business cycle, but also the属性of "supply-constrained assets". Options market data shows that although some non-ferrous metals show signs of overheating, traders still expect gold to have further upside potential in the long term.

This logic also provides a basis for allocating to resource country stocks. Copper (e.g., Chile) reflects the rigid demand for electrification and industrial infrastructure; precious metals (e.g., South Africa) have the dual属性of commodity upside and risk premium. For portfolios, they should be seen as a "supply constraint factor".

Second is AI infrastructure. The allocation focus should return to the reality of the balance sheet: computing power, energy, data centers, and cooling systems. Rather than chasing application-layer software narratives, it's better to lock in the new round of physical infrastructure. Markets like South Korea, which are at the interface of the global computing power industry (semiconductors/electronics), have become direct beneficiaries of the AI Capex cycle due to their more visible capital expenditure and policy support.

Furthermore, defense and security have returned to investors'视野. Influenced by the normalization of geopolitics, defense spending has become a rigid fiscal function constrained by national security. Although this sector is often volatile, it plays a crucial "tail insurance" role in portfolios. Meanwhile, the allocation value of Hong Kong stocks and Chinese assets lies in their low valuation and low correlation with欧美assets, providing scarce hedging value in the regionalization era.

Rates & Treasuries: Keep the Curve Steepening

The core contradiction in the 2026 rates market can be summarized in one sentence: the front end of the curve is determined more by the monetary policy path, while the long end is more like a "container" for term premium. Rate cut expectations do help压低front-end yields, but whether the long-end falls in sync depends on whether tail risks of inflation, fiscal supply pressure, and political uncertainty allow the term premium to continue contracting. In other words, the "stubbornness" of the long end may not mean the market mispriced the number of rate cuts; it could also mean the market is repricing long-term risk.

Supply dynamics amplify this structural difference. Changes in the US fiscal financing structure directly affect the supply-demand格局of different maturities: when the money market has the ability to absorb, front-end supply is more easily absorbed. In contrast, the long end is more prone to "pulse-like" fluctuations driven by risk budget constraints and changes in term premium. The implication for portfolios is clear: duration exposure should be managed in layers, avoiding押注on a single path — such as "inflation completely disappears, term premium returns to ultra-low levels". Structural curve trades (e.g., steepener strategies) can persist not just because of superior trading skills, but also because they fit the different pricing mechanisms of the curve's front and long ends.

Cryptocurrency: Digital Commodity vs Risk Asset

In 2026, the crypto market will see sharper internal differentiation. Bitcoin, as a non-sovereign, rules-based "digital commodity", is more easily accepted as a payment alternative and hedging tool under the regionalization narrative. In contrast, equity-like tokens perform more like high-risk assets. In an environment of clear regulation and decent risk-free yields, they must provide extremely high risk compensation to justify their allocation value.

Therefore, crypto asset allocation should adopt "separate account management": place Bitcoin within the commodity framework, using small weights to acquire convexity; treat equity-like tokens as high-volatility risk assets, setting stricter return thresholds.

With "Hard Constraints" as the Core, "Structural Differentiation" as the Engine

In summary, the core of building a 2026 portfolio lies in managing a series of "hard constraints", not单纯的prediction. This means restoring the strategic status of commodities and resource stocks to应对supply bottlenecks, locking in profit visibility using the capital expenditure of AI infrastructure, and enhancing portfolio's韧性relying on the policy order flow of the defense sector; at the same time, one needs to adapt to the reshaping of the return distribution of the bond market by the return of term premium, and use the valuation differences of selected non-US assets to provide structural hedging.

This does not require investors to perfectly predict every macro event. On the contrary, in the regionalization era, the scarcest ability is to reduce reliance on "perfect prediction": let hard assets absorb structural demand, let the interest rate curve absorb macro differentiation, and let hedging factors absorb market noise. The trading philosophy of 2026 is no longer trying to "guess the answer", but to "acknowledge constraints" — and据此completely reset the priority of asset allocation.

Welcome to join the ChainCatcher official community

Telegram subscription:https://t.me/chaincatcher;

Official Twitter account:https://x.com/ChainCatcher_